On the cusp of the conclusion of the “14th Five-Year Plan” and the commencement of the “15th Five-Year Plan”, China Duty Free Group (CDFG), a leader in the travel retail industry, has released its CDFG Consumer White Paper (hereinafter referred to as the “White Paper”) for the second consecutive year. Rooted in authentic consumption data and contextualized by industry performance, macroeconomic trends, and duty-free policies, the White Paper offers deep insights into the drivers behind the industry’s recovery. It offers a comprehensive analysis of the value of CDFG’s users and members, the characteristics and consumption habits of nine key customer segments, and their evolving needs. It also outlines strategies to enhance value in five core categories and looks ahead to future opportunities, providing practical insights for the industry’s ecosystem development.

Chapter 1: The Competitive Landscape of the Global Duty-Free and Travel Retail Market

I. Industry Recovery: Multiple Factors Drive New Growth Opportunities

The industry’s recovery and growth are driven by three key factors: macroeconomic rebound, the revival of tourism consumption, and policy benefits.

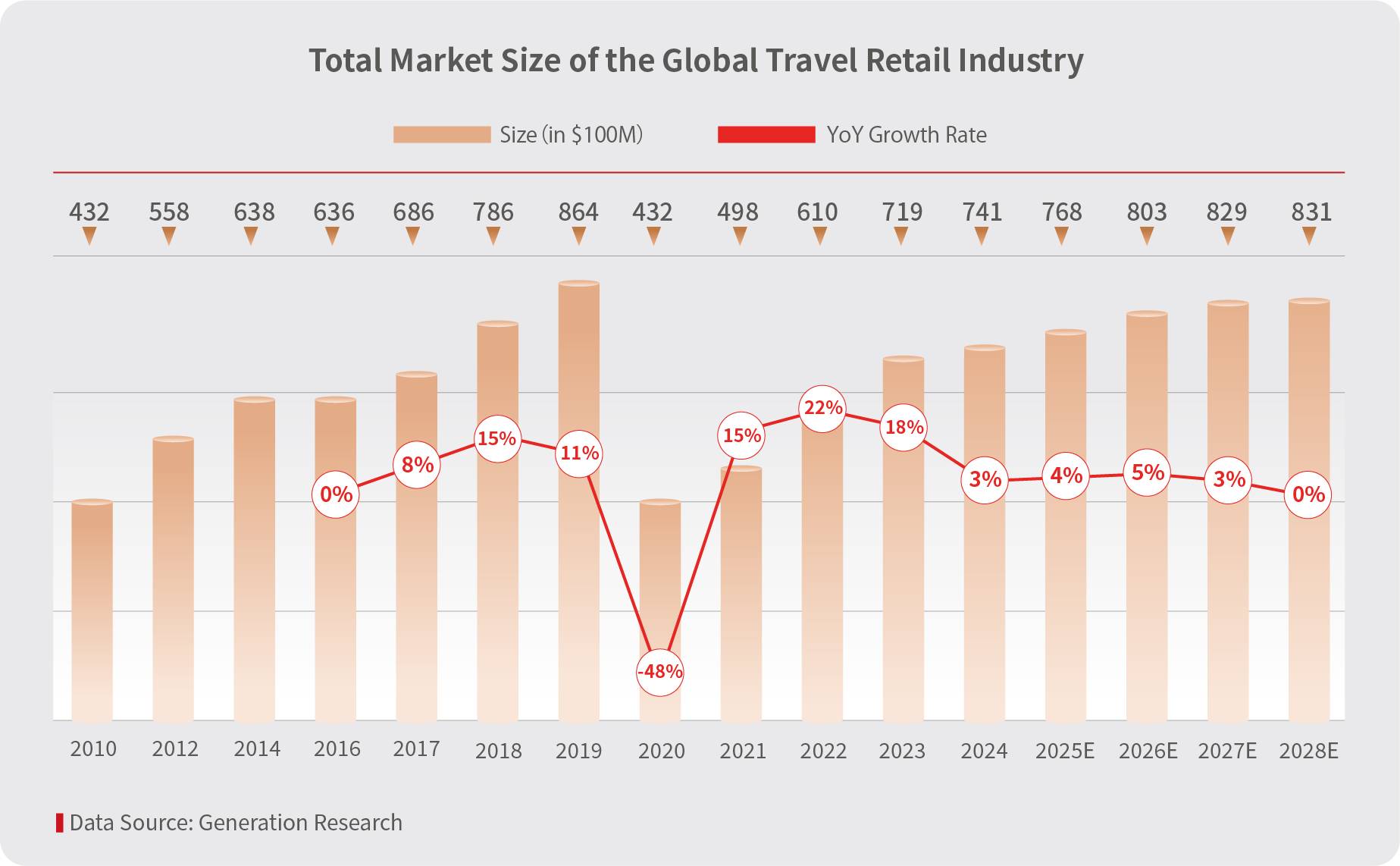

1. Global Market Maintains Recovery Momentum

In 2024, the global duty-free and travel retail market reached a scale of $74.13 billion, a year-on-year increase of 3%, recovering to 85.8% of its 2019 level. This rebound is driven by a confluence of factors, including the recovery of international tourism, policy support and market liberalization, the rise of emerging markets, and digital transformation, continuously invigorating the industry.

Source: CDFG Consumer White Paper 2024-2025

2. China’s Market Highlights Its High-Potential Foundation

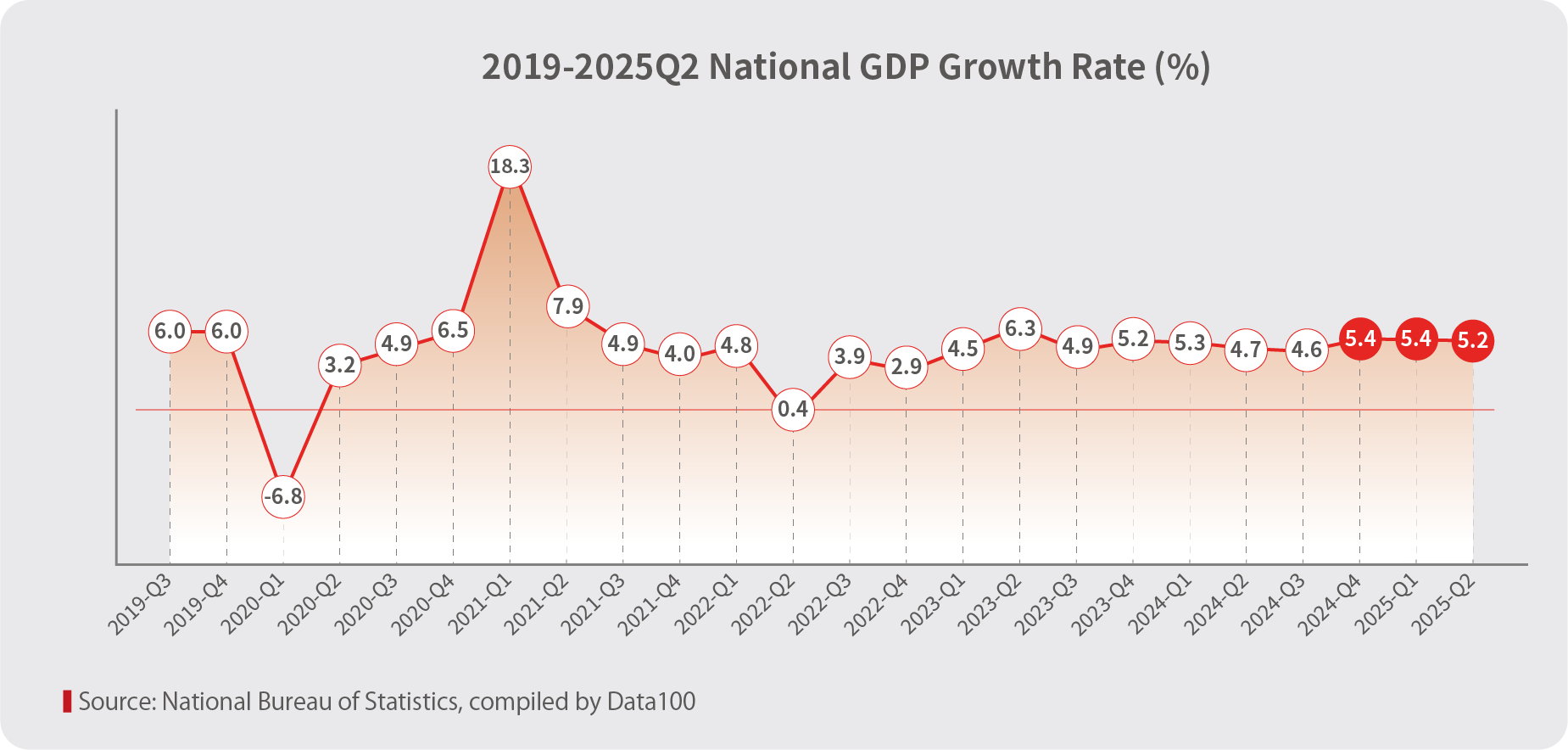

(1) Underpinned by the Dual Foundations of Macroeconomic and Tourism Recovery

From a macroeconomic perspective, China’s GDP has returned to healthy growth after a period of adjustment. The combined effect of supportive policies and expanding domestic demand has stabilized consumer confidence, providing a solid foundation for the industry.

Source: CDFG Consumer White Paper 2024-2025

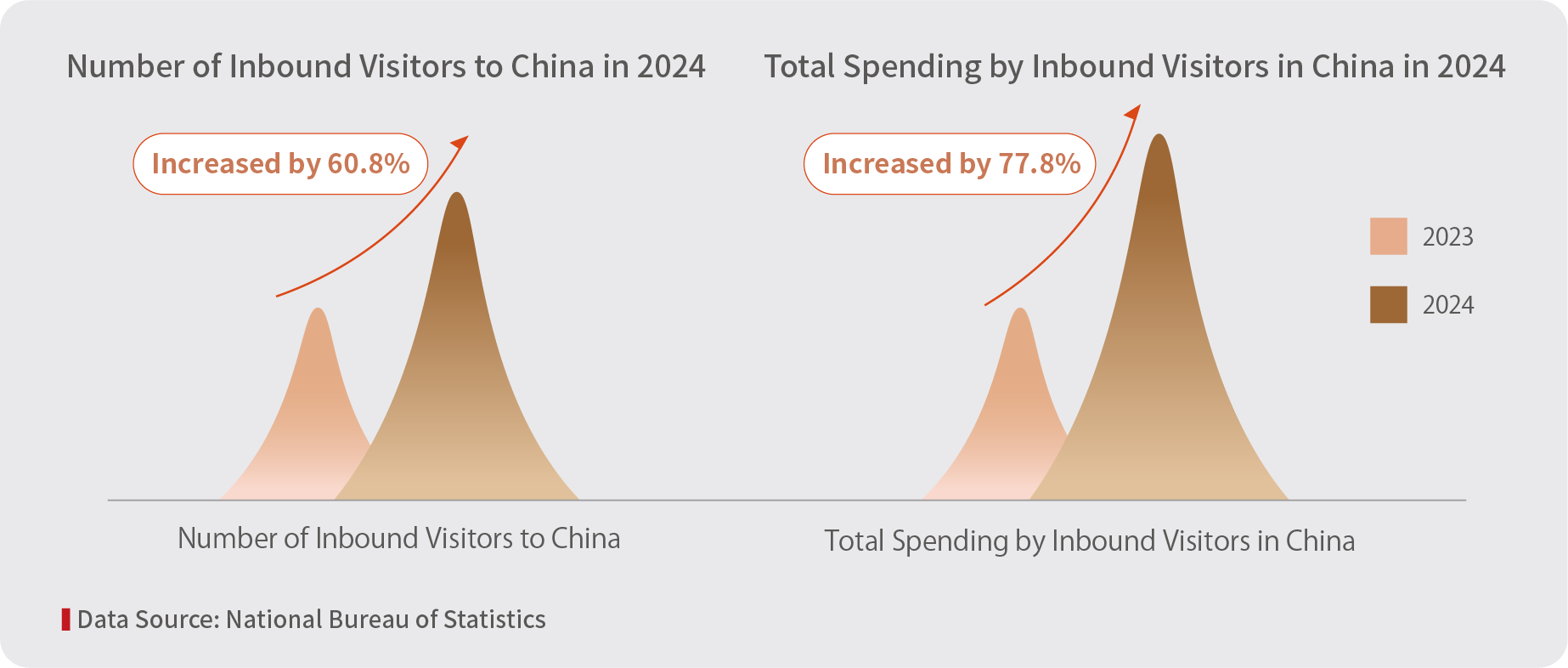

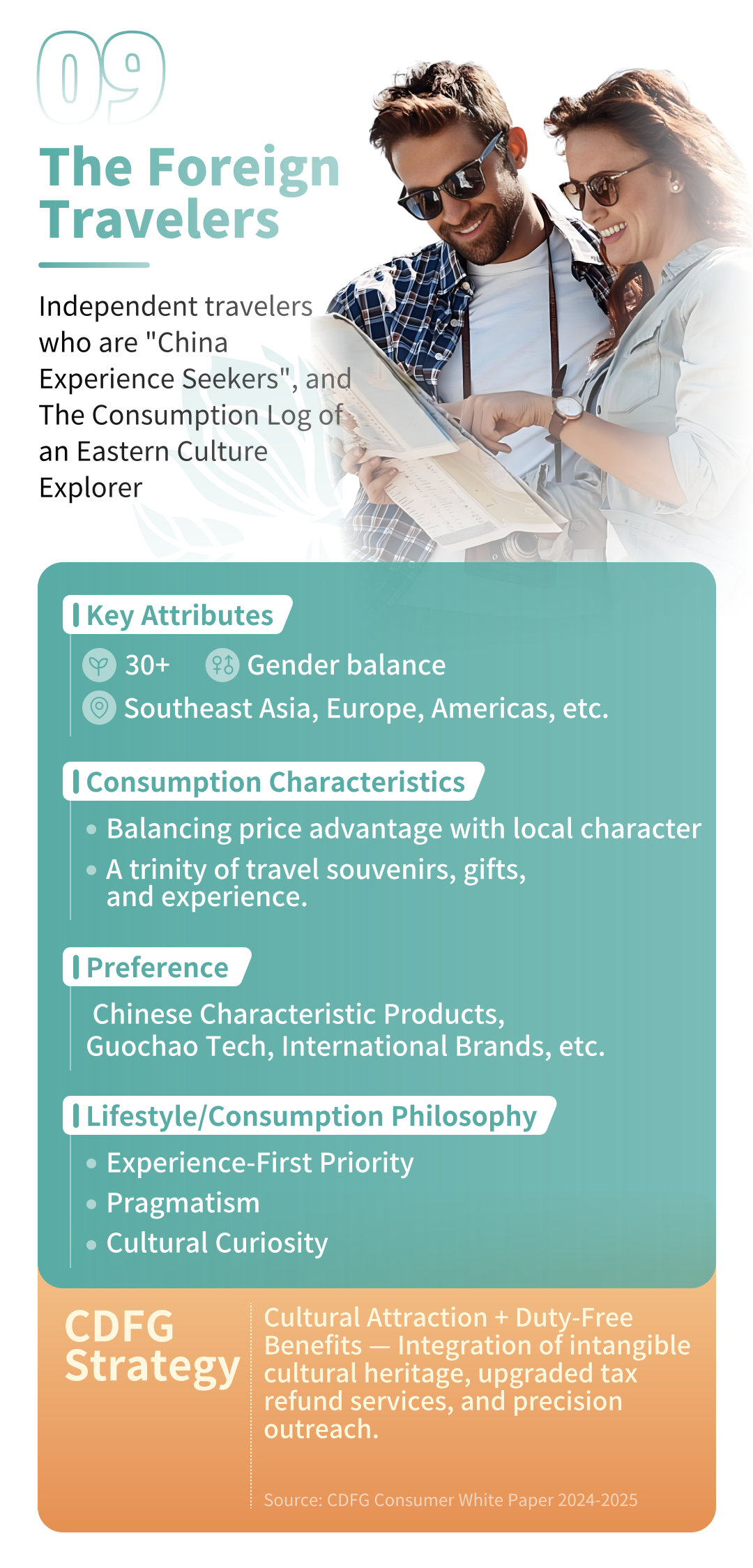

The recovery of tourism consumption has become a key driver. On one hand, domestic and outbound tourism continue to see a steady recovery and growth. On the other hand, the number of inbound tourists to China in 2024 increased by 60.8% year-on-year, with total spending surging by 77.8%. Coupled with policies such as visa-free entry and payment facilitation, cross-border consumption has seen strong momentum.

Source: CDFG Consumer White Paper 2024-2025

(2) Policy Benefits Broaden Market Space

Specifically, Hainan’s offshore duty-free program enhanced the shopping experience by adding new pickup methods such as “Mail Delivery”, “Island Pickup Upon Return”, “Pickup on Guarantee”, and “Buy and Go”. These were complemented by stimulus measures like consumption vouchers and the active promotion of innovative marketing collaborations, accelerating the “Duty-Free+” industrial integration. Meanwhile, downtown duty-free policies have encouraged market players to vigorously pursue innovation and continuously optimize the consumer experience. The continuous release of these policy dividends is steadily expanding the market space for China’s duty-free and travel retail market.

II. The Leader Takes the Lead: CDFG’s Omnichannel Ecosystem Strategy Delivers Results

In China’s 2024 duty-free and travel retail market, CDFG firmly ranked first with a 78.7% market share, far surpassing its competitors. Its solid leadership position stems from the deep implementation of its omnichannel ecosystem strategy.

Source: CDFG Consumer White Paper 2024-2025

Leveraging its advantages in industry leadership, omnichannel layout, supply chain, member value management, and capital and technology drivers, CDFG, along with its numerous partners, achieved higher-quality development in 2024.

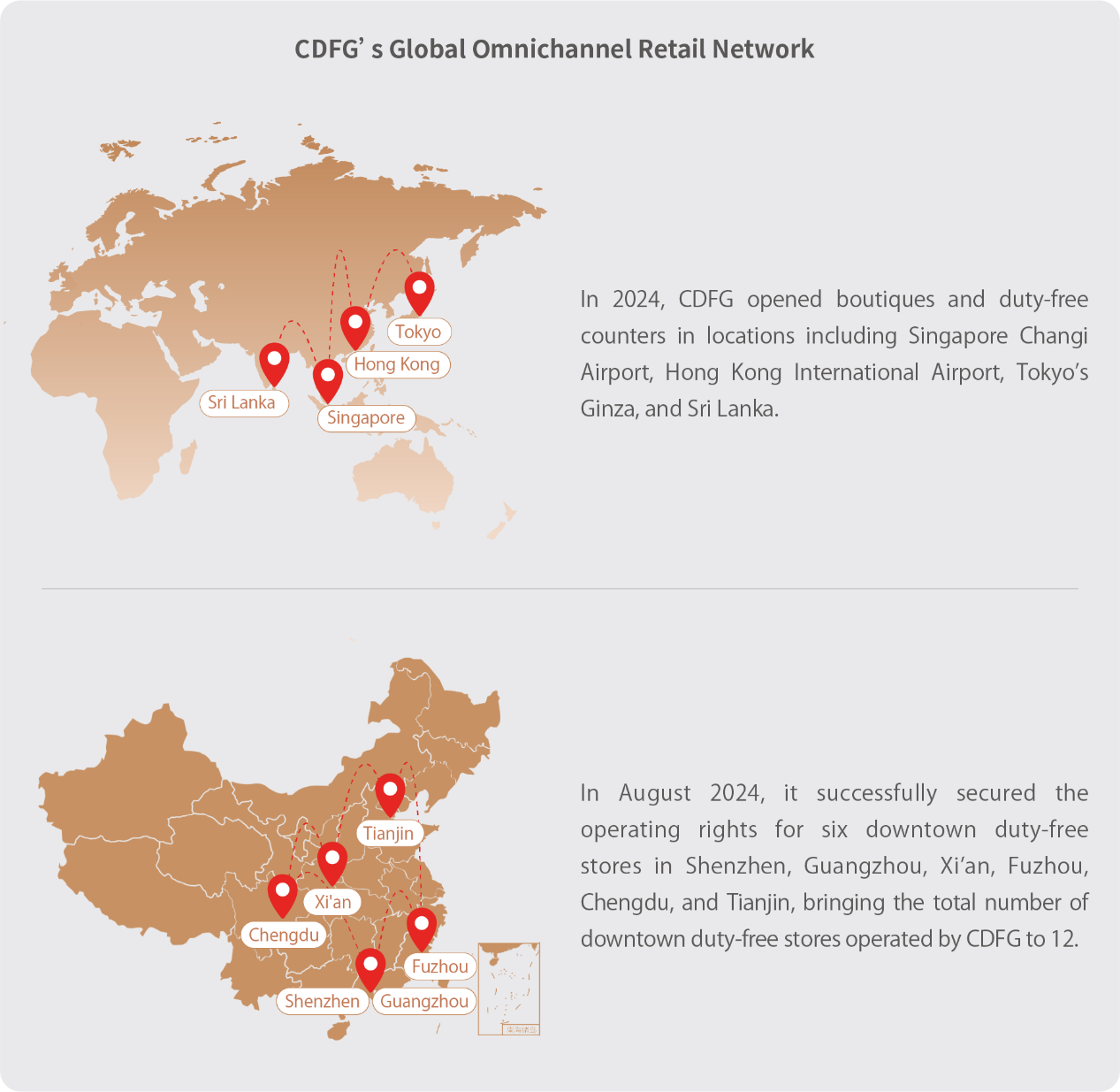

1. Omnichannel Layout: Weaving an Extensive Global Retail Network

In 2024, CDFG accelerated its globalization, launching overseas locations such as Singapore Changi Airport and Tokyo’s Ginza. It successfully secured the operating rights for six downtown duty-free shops in cities like Shenzhen and Guangzhou, increasing its total number of downtown shops in mainland China to 12. This has strengthened its network structure of “domestic-international linkage and online-offline synergy”.

Source: CDFG Consumer White Paper 2024-2025

2. Supply Chain Advantage: Building a Full-Category Matrix

Relying on its global supply chain system, CDFG has established a brand matrix spanning all categories. It has partnered with over 1,500 renowned international brands, offering more than 360,000 unique products (SKUs). In 2024, it added over 200 domestic and international brands and exclusively launched more than 500 globally limited-edition items, meeting diverse demands with an extensive selection.

Source: CDFG Consumer White Paper 2024-2025

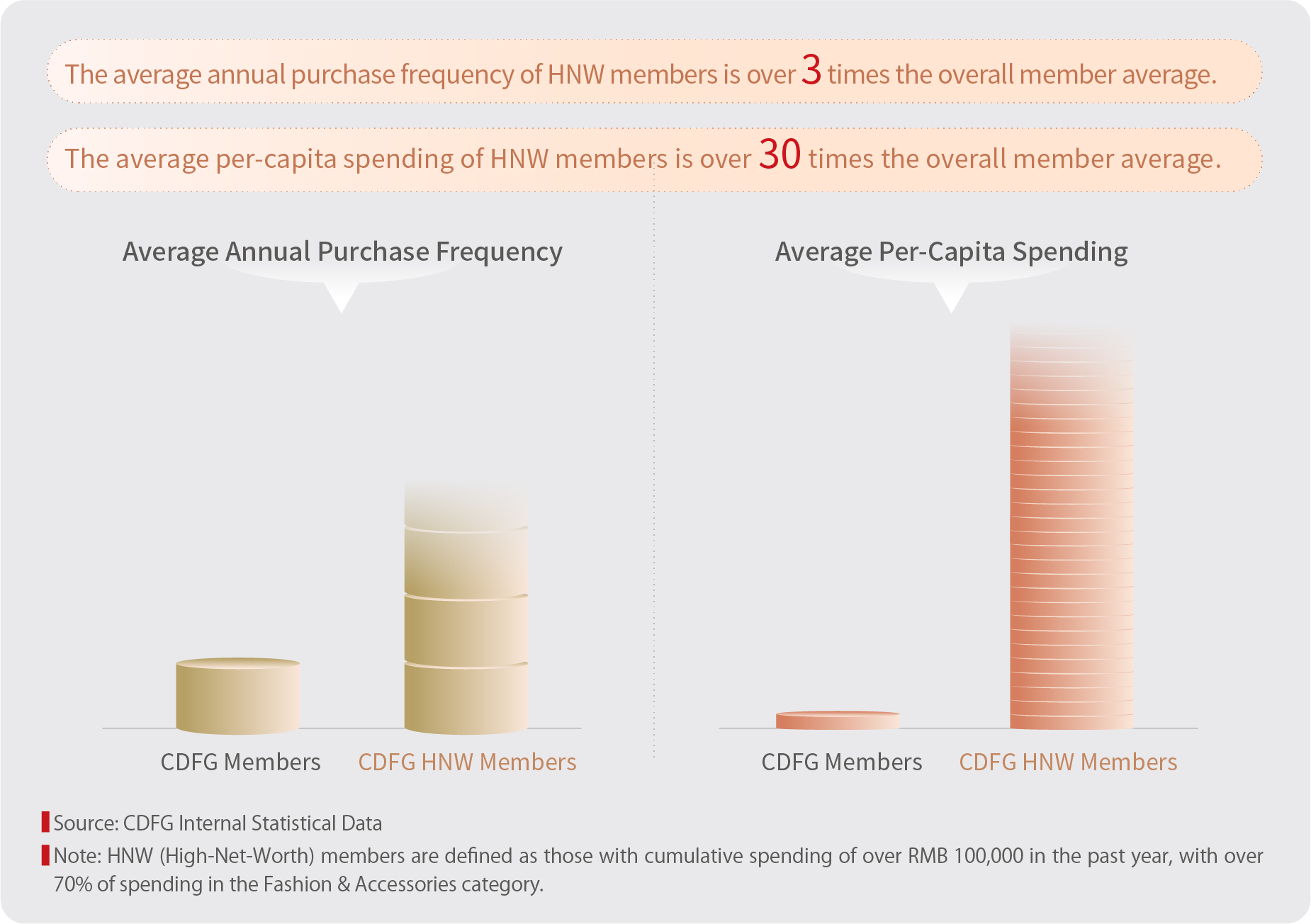

3. Member Value Management: Enhancing Consumer Loyalty through Meticulous Operations

CDFG’s total membership surpassed 45 million by June 2025. The performance of HNW (High Net Worth) members is particularly outstanding: their average annual purchase frequency is over 3 times the overall average, and their per-capita spending is more than 30 times higher, making them a core growth engine.

Source: CDFG Consumer White Paper 2024-2025

CDFG’s industry leadership position is primarily due to the deep implementation of its omnichannel ecosystem strategy. This includes initiatives such as: deepening the integration of culture, business, sports, travel, and wellness through Hainan’s “Duty-Free+” innovative model; achieving high revenue growth in its Beijing and Shanghai airport shops; accelerating the layout of overseas businesses in Singapore, Hong Kong, and Japan; establishing 12 downtown duty-free shops in mainland China; promoting Chinese brands globally (“Guochao (China Chic) Going Global”); and deepening its 45-million-strong membership system and digital operations.

Chapter 2: A Comprehensive Overview of CDFG Consumers

I. Value Enhancement: Breakthrough Growth in User Scale and Healthy Adjustment of Membership Structure

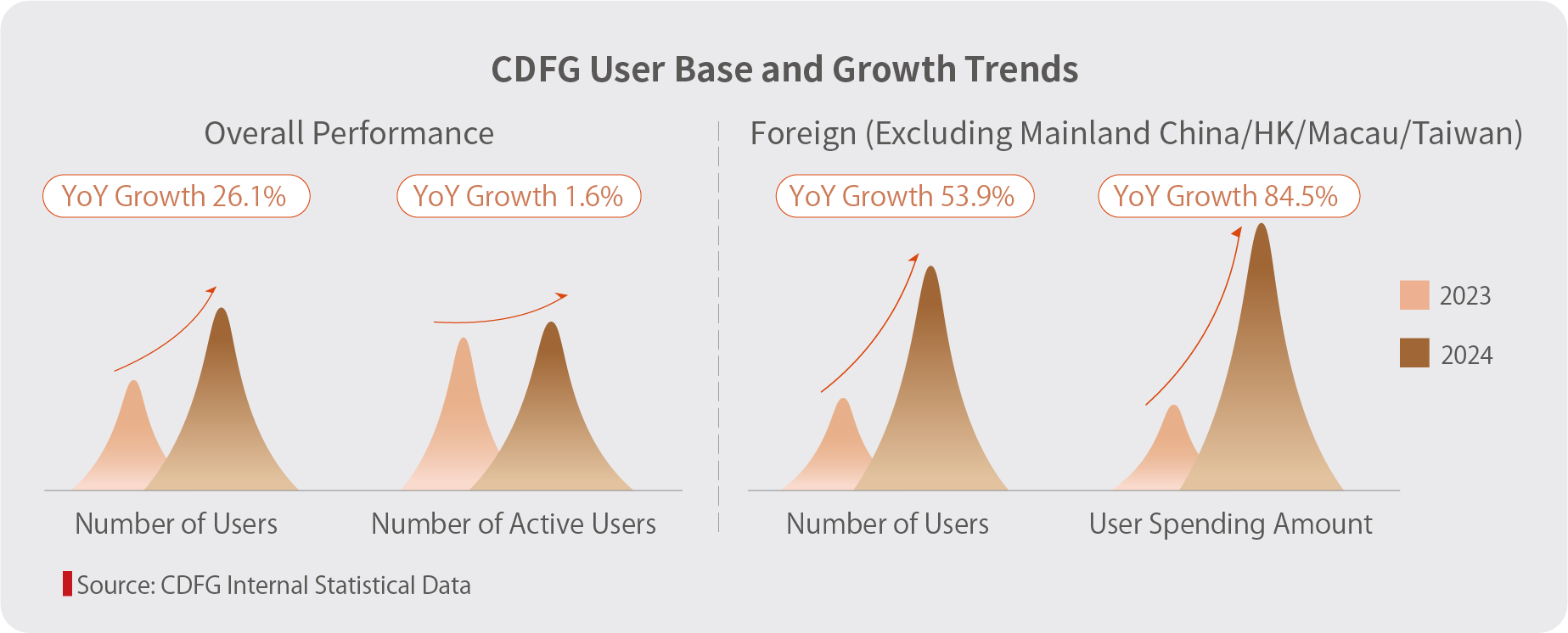

1. CDFG’s User Base Achieves Breakthrough Growth, with Strong Performance from Foreign Users

In 2024, the total user base reached 104 million, a YoY increase of 26.1%. Foreign users showed particularly outstanding performance, with the number of users growing by 53.9% and their spending increasing by 84.5%.

Source: CDFG Consumer White Paper 2024-2025

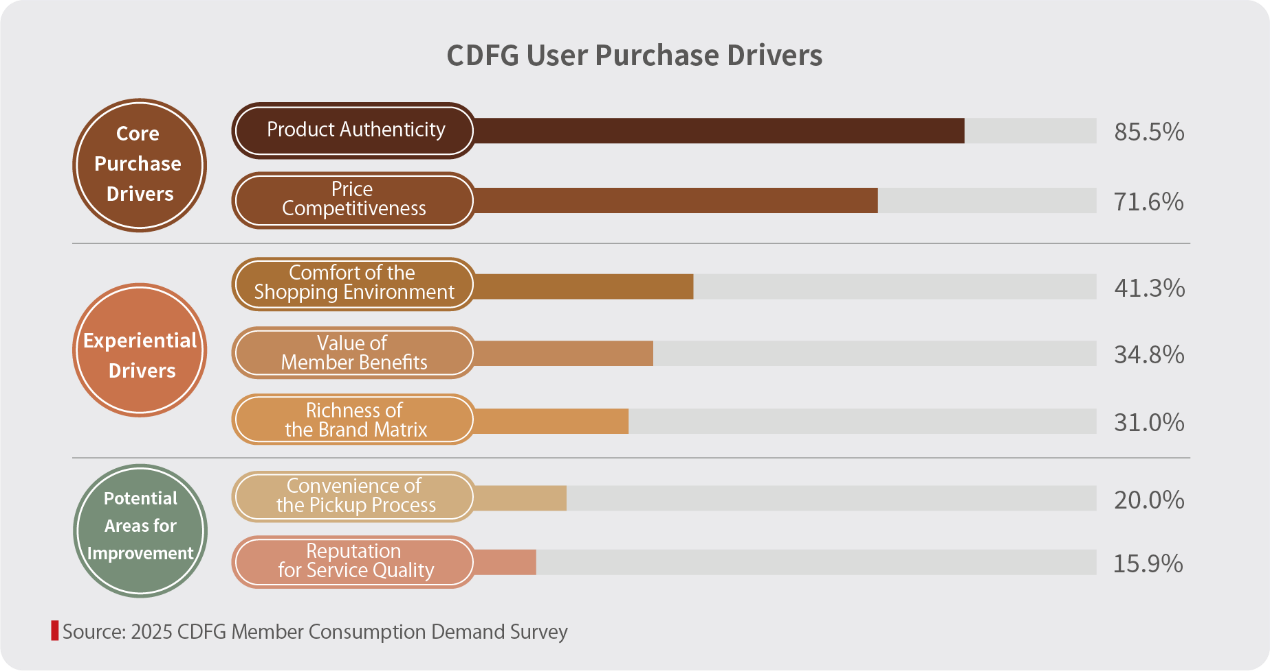

Behind this user growth, beyond the continuous policy benefits, are CDFG’s own ongoing optimizations in strategy, supply chain, marketing, and channels. It is also driven by core factors such as “Product Authenticity, Price Advantages, Shopping Environment, and Member Operations”.

Source: CDFG Consumer White Paper 2024-2025

2. CDFG’s Member Value Further Increases, Revealing Three New Characteristics

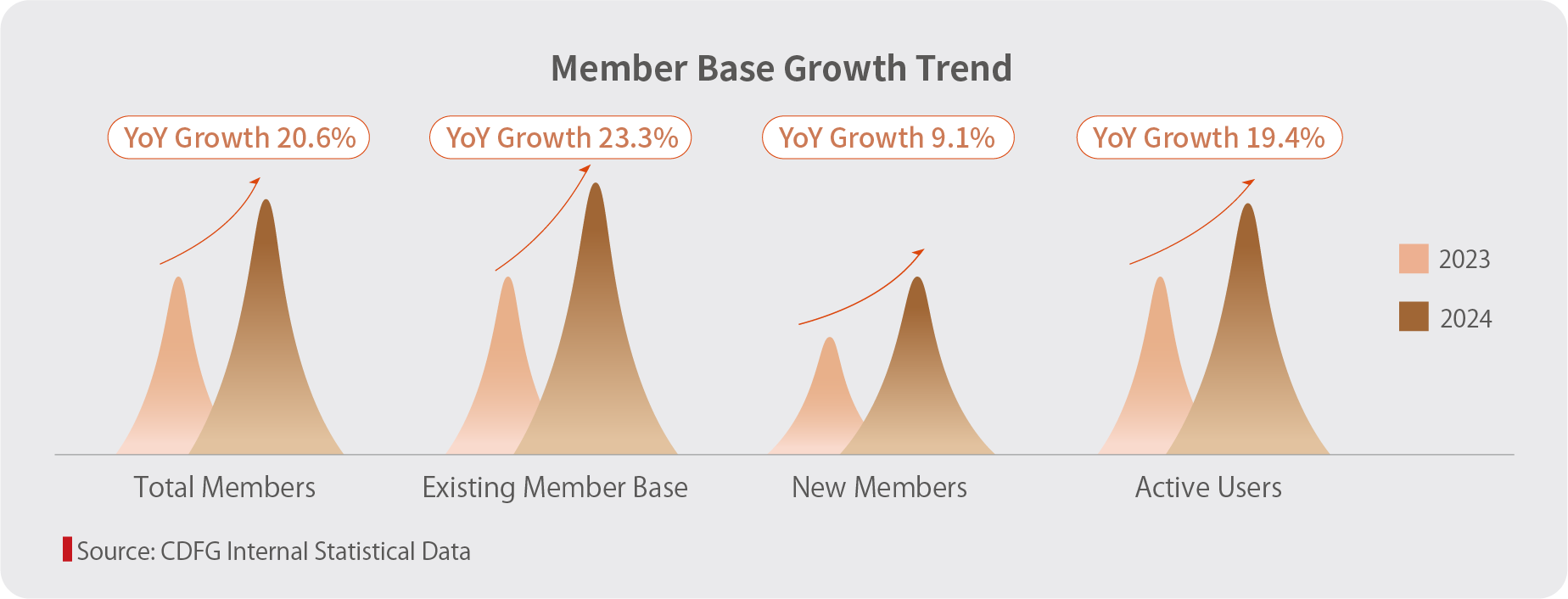

CDFG’s total membership continues to grow, with a significant year-on-year growth rate and a stable month-on-month increase. The existing member base is expanding concurrently. The YoY increase in the number of active members is particularly prominent, while their proportion of the overall membership remains stable.

Source: CDFG Consumer White Paper 2024-2025

On the foundation of stable overall growth and a healthy structural adjustment, CDFG’s member base also exhibits three new characteristics.

New Trait 1: Bolstering the User Base from Both Mass-Market and High-Luxury Ends

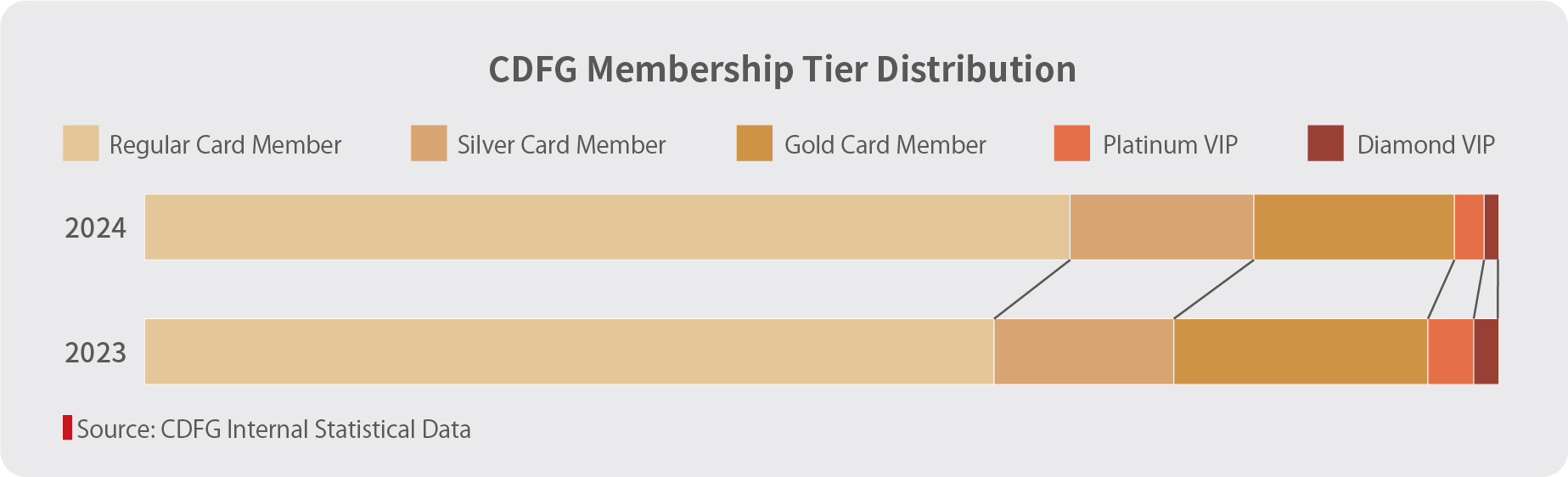

In 2024, the proportion of regular card members rose to 68%, expanding the foundational user base. The share of high-luxury customers showed a recovery trend in the fourth quarter, with stable month-on-month growth, indicating resilient high-end consumption.

Source: CDFG Consumer White Paper 2024-2025

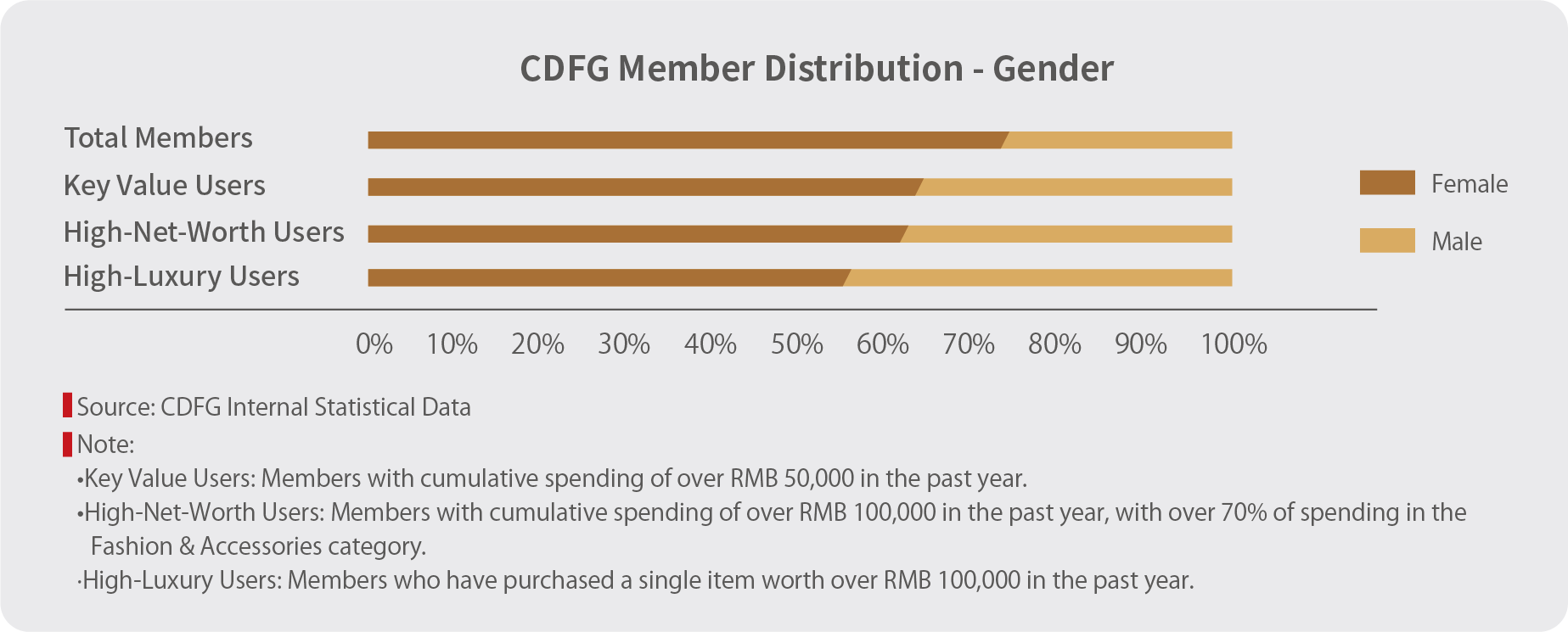

New Trait 2: Men Emerge as a Key Growth Driver in High-End Consumption

Although female members still hold an absolute majority in numbers, the proportion of men among HNW and high-luxury customers is generally higher than their share in the overall membership, with a particularly strong presence in high-end consumption segments.

Source: CDFG Consumer White Paper 2024-2025

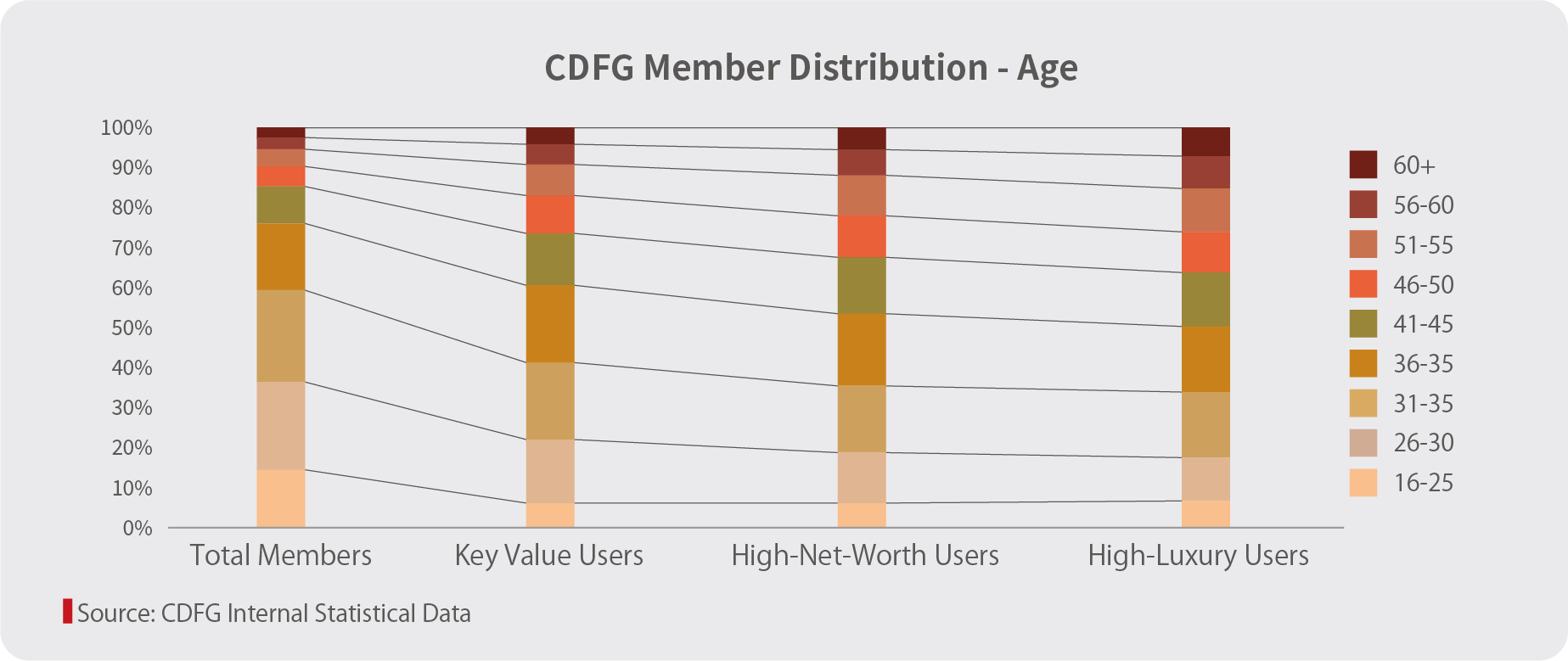

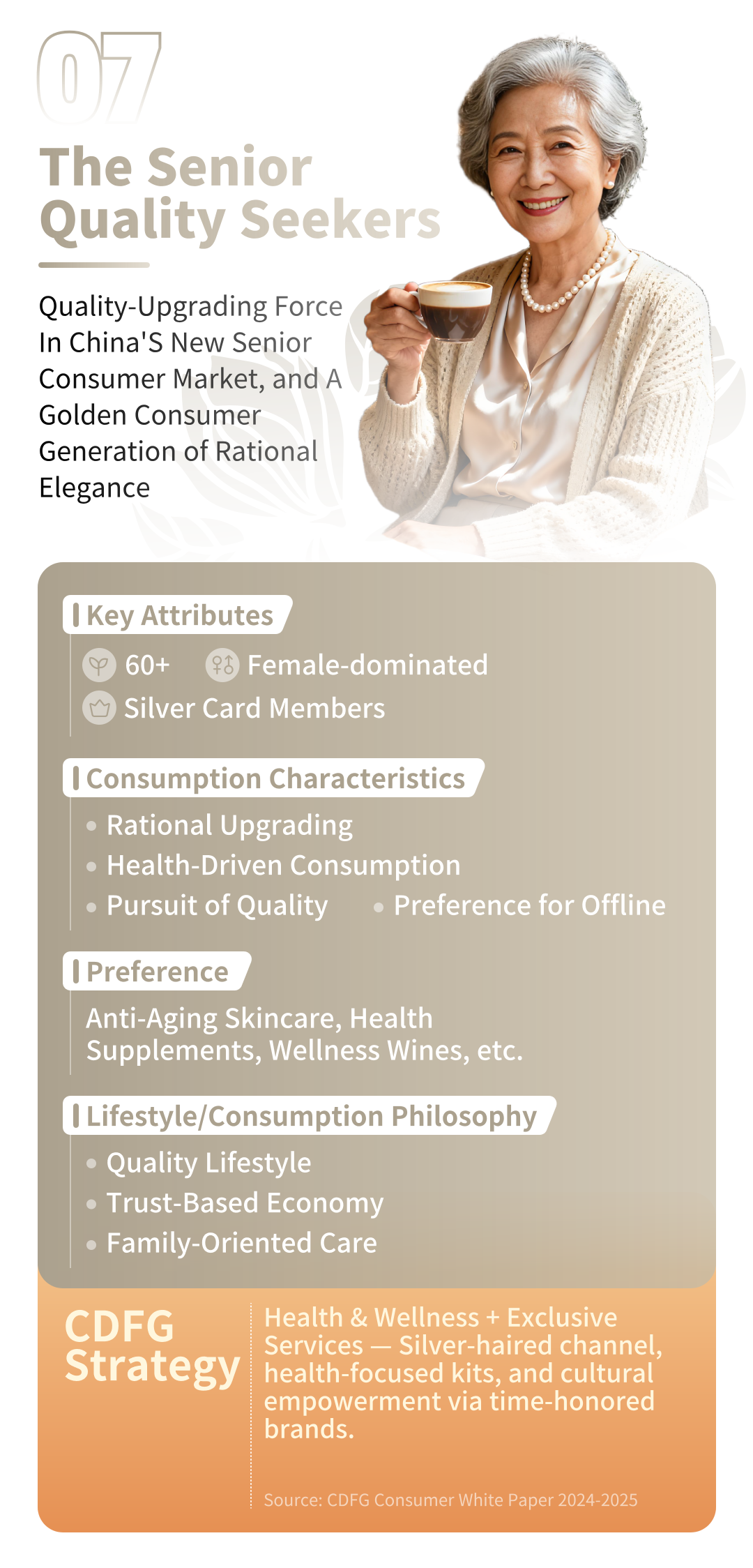

New Trait 3: The Driving Force of the Senior Demographic Becomes Increasingly Evident

The year-on-year growth rate for members over 60 is the most significant, with a month-on-month increase of up to 47%. The proportion of the over-50 demographic among HNW and high-luxury customers far exceeds their share of the total membership.

Source: CDFG Consumer White Paper 2024-2025

II. Customer Base Reshaping: From “Scale Expansion” to “Meticulous Segment Cultivation”

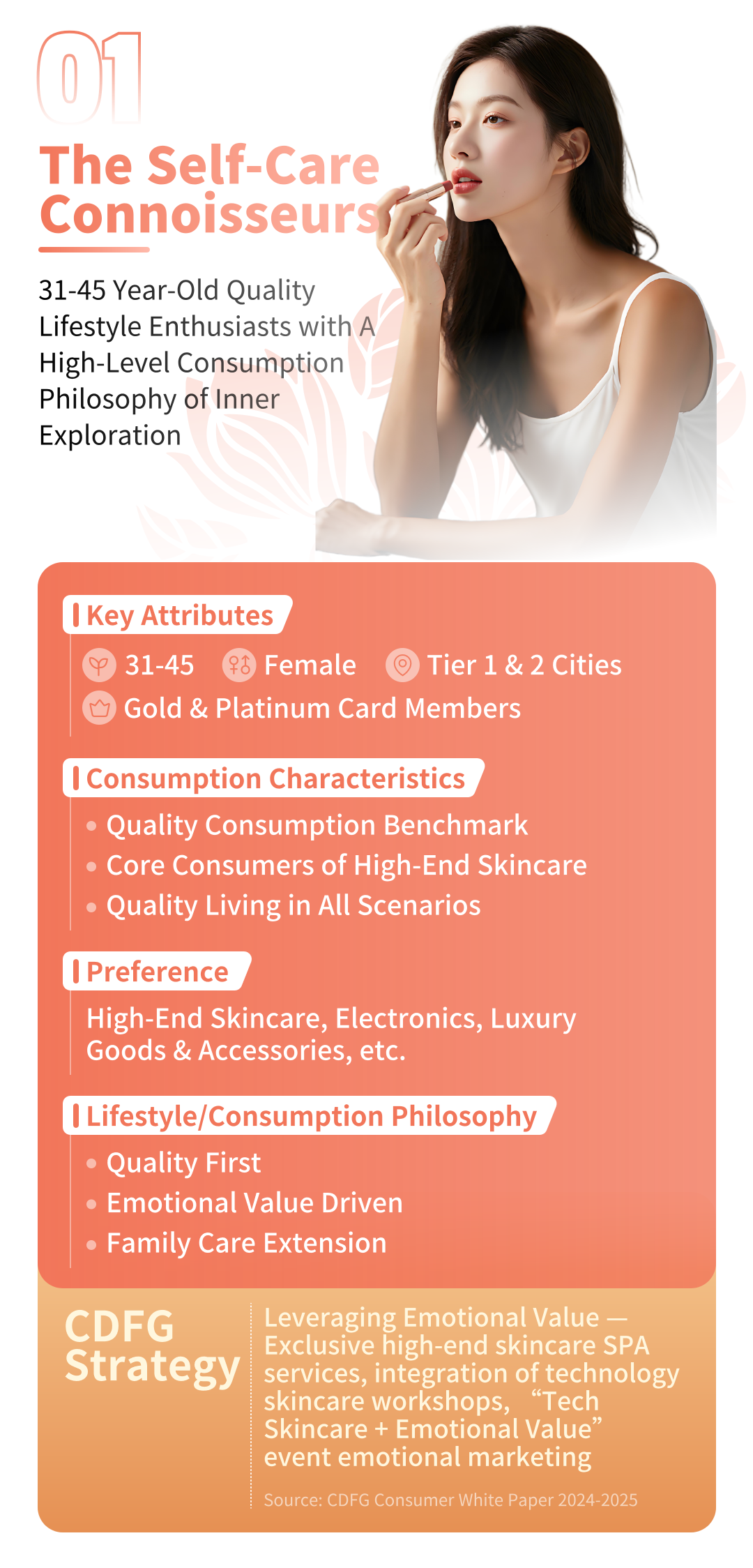

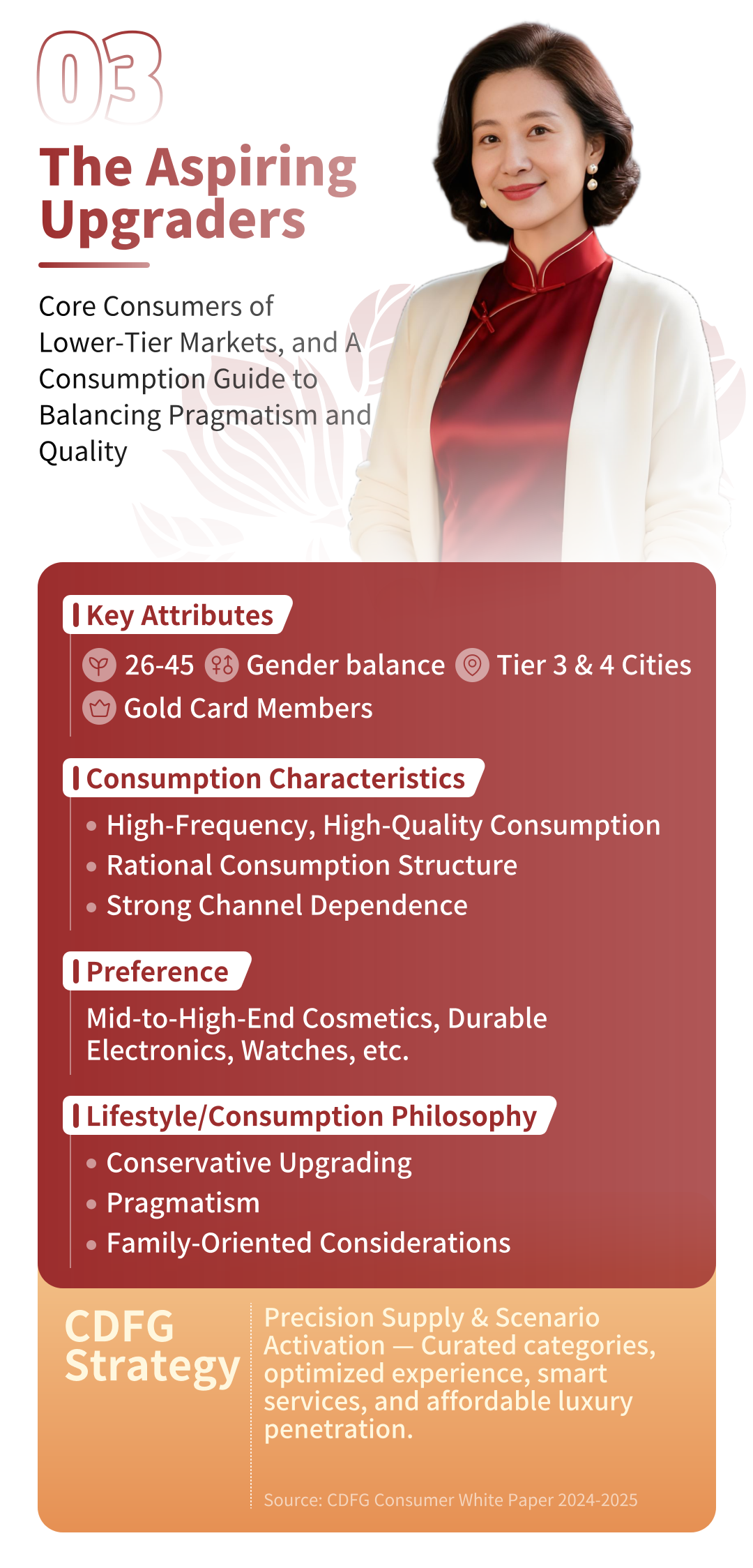

Based on dimensions such as consumption contribution, category preference, age, and region, CDFG’s core customer base can be segmented into nine categories that precisely cover diverse consumption needs: The Self-Care Connoisseurs, aged 31-45 from first- and second-tier cities, focus on high-end skincare; HNW Luxury Lifestyle Connoisseurs favor watches and jewelry; The Aspiring Upgraders from third- and fourth-tier cities pragmatically pursue quality; male Spirits Aficionados aged 31-50 are keen on premium liquor; The Tech Adventurers aged 21-35 focus on technology products; Gen Z Trend-Driven Stylists aged 16-30 follow makeup trends; The Senior Quality Seekers aged 60+ prioritize health-related consumption; The Performance Athletes aged 26-45 choose professional gear; and The Foreign Travelers favor products with unique Chinese characteristics. The distinct consumption preferences of each group inject vitality into consumption upgrading and meticulous segment cultivation.

Overview of the Nine Customer Segment Profiles

Chapter 3: Category Trends and Growth Engines in Duty-Free and Travel Retail

I. Category Upgrade: From “Material Consumption” to “Meaningful Consumption”

Duty-free consumption is shifting from “buying goods” to “buying a lifestyle”. On one hand, consumption boundaries are continuously expanding, extending from traditional luxury goods and cosmetics to emerging categories like wellness, collectible toys, and outdoor sports. This signifies that duty-free shopping has evolved from a simple transaction into a multi-dimensional expression of lifestyle. On the other hand, consumer demand for scarcity and uniqueness has given rise to a new value assessment system. Limited-edition items and customized sets have not only become status symbols but are also imbued with emotional value and social significance. This transformation reflects a fundamental shift in consumer motivation. Consumers are no longer satisfied with product functionality alone; they now seek the cultural substance and social capital behind the products and are willing to pay a premium for uniqueness.

II. Consumption Growth Shows New Trends: “The Rise of Guochao”, “The Experience Economy”, and “Channel Integration”

The Rise of “Guochao”: The Value Restructuring of Domestic Brands

The Rise of “Guochao”: The Value Restructuring of Domestic Brands

Through product innovation and cross-over collaborations, domestic brands have achieved a breakthrough in brand premium within the travel retail market. The enthusiasm of young consumers for “Guochao” products is changing the long-standing dominance of international brands in the travel retail market, creating new points of value growth.

The Rise of the Experience Economy: The Transformation of Shopping Scenarios into Content

The Rise of the Experience Economy: The Transformation of Shopping Scenarios into Content

Experiential elements like immersive displays and art installations are upgrading duty-free shopping from a transactional activity to a form of content consumption. This shift requires operators to transform from being mere merchandise suppliers into providers of lifestyle content.

The Evolution of Channel Integration: Digital Reshaping of the Duty-Free Shopping Experience

The Evolution of Channel Integration: Digital Reshaping of the Duty-Free Shopping Experience

The boundaries between online and offline channels are increasingly blurred. Innovative initiatives such as the application of AR/VR technology and online-exclusive SKUs are building a new consumption loop of “Online Ordering + Offline Experience”. This integration not only enhances conversion efficiency but also redefines the spatio-temporal dimensions of duty-free shopping.

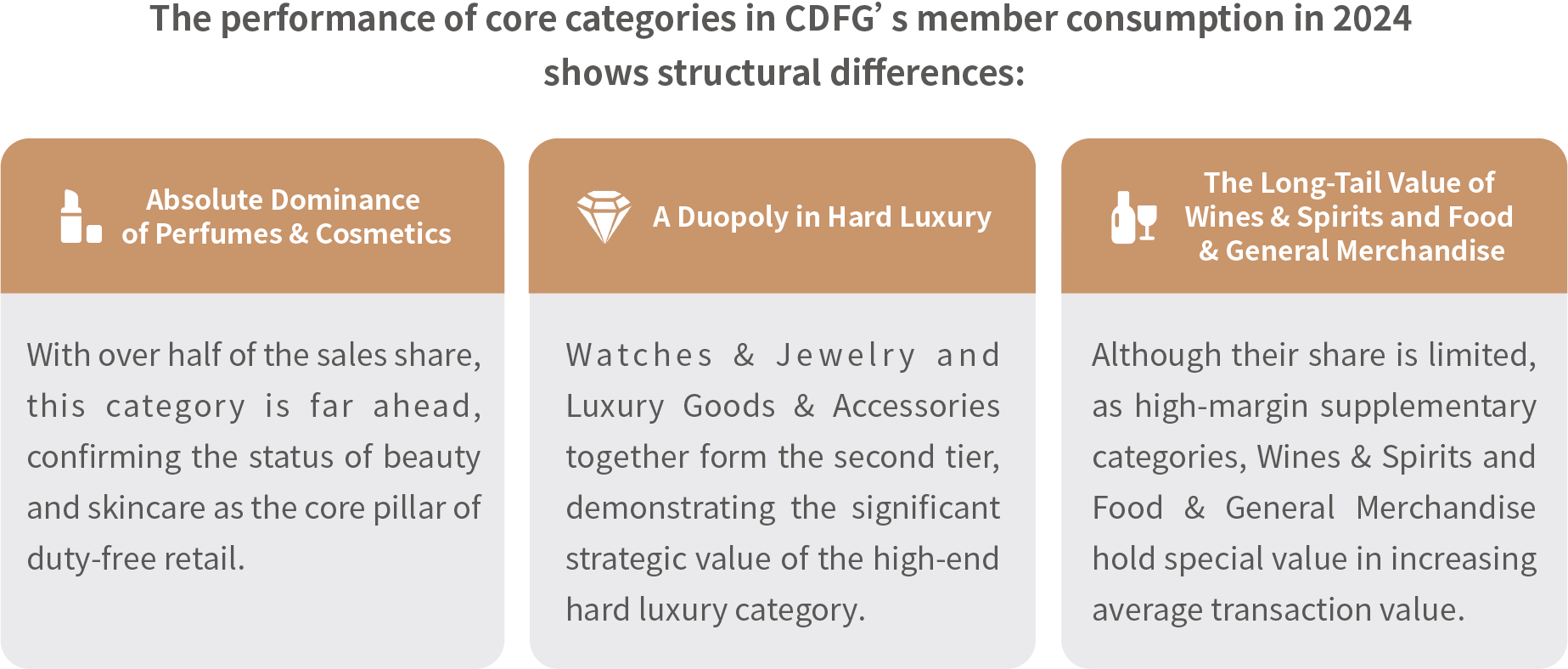

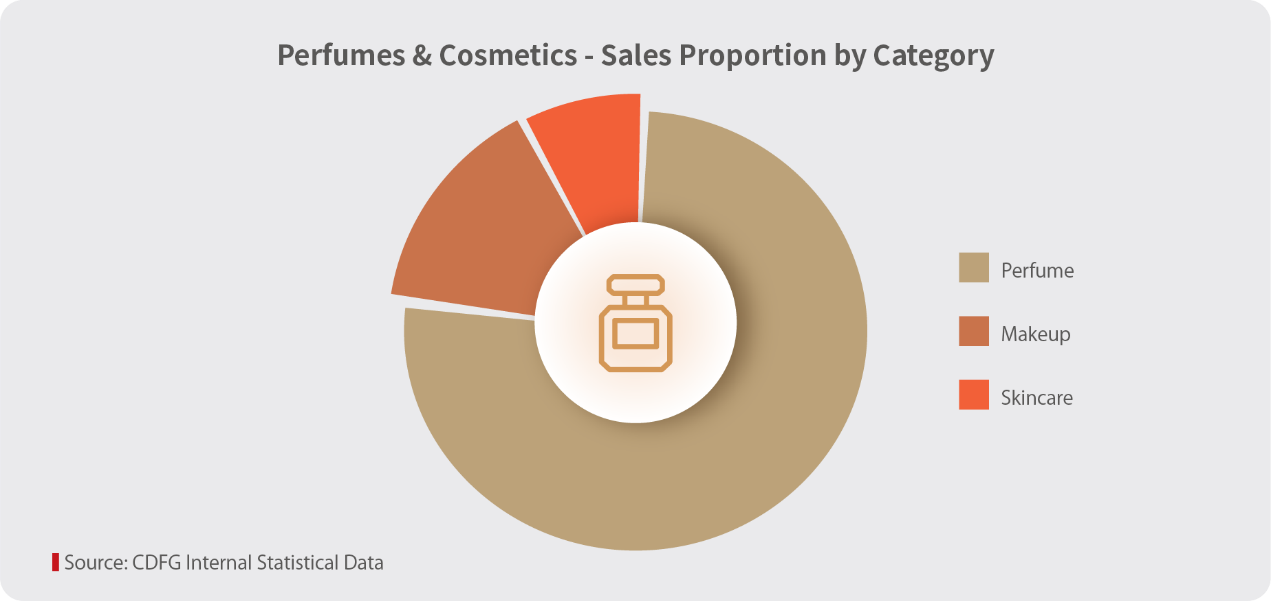

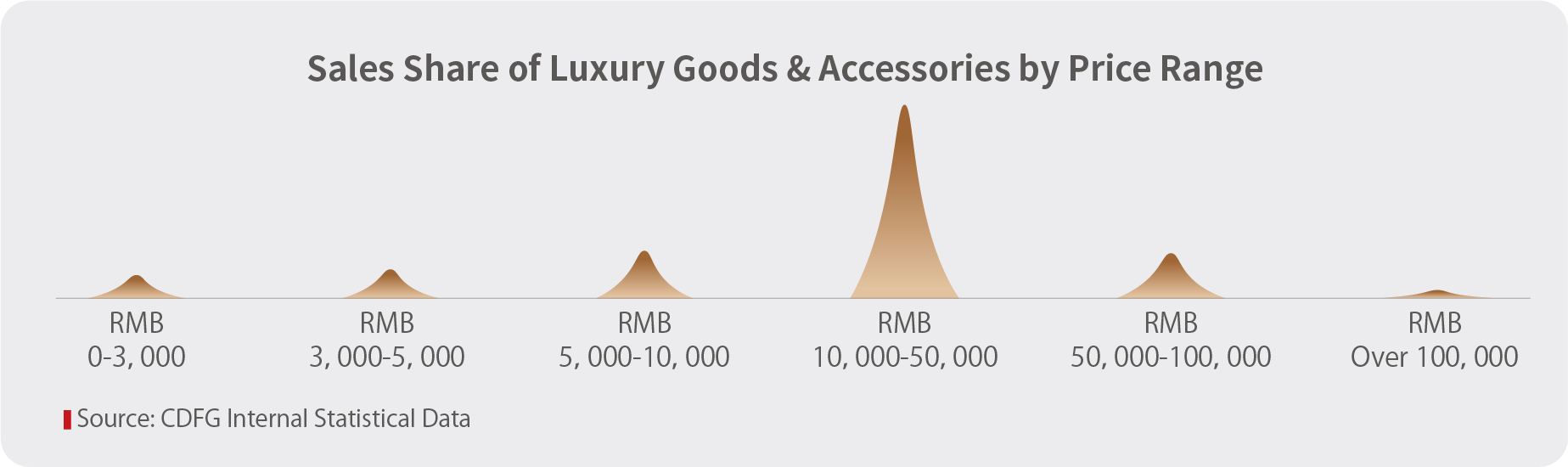

III. Category Consumption Reveals a New Landscape: “Beauty Dominates”, “Hard Luxury Holds Ground”, and “Wines & Spirits Breaks Through”

Source: CDFG Consumer White Paper 2024-2025

1. Perfumes & Cosmetics: Makeup and Perfume Show Strong Growth; Foreign Travelers, Male Customers, and Guochao Brands Emerge as Key Growth Drivers

Skincare remains dominant, while makeup and perfume each grew by nearly 10%. The growth in the perfume category is primarily driven by offline channels like airports, especially from foreign travelers (e.g., consumers from Japan, South Korea, Europe, and America) and mature male customers aged 36-50. The growth in makeup is mainly driven by the 16-40 age group, with domestic brands attracting a large number of Gen Z consumers.

Source: CDFG Consumer White Paper 2024-2025

Source: CDFG Consumer White Paper 2024-2025

For the Perfumes & Cosmetics category, CDFG boosts repeat purchase rates through “Offline Customized Skincare Solutions + Online Precision Marketing”. In offline channels, CDFG enhances the high-end experience with two core strategies: first, collaborating with luxury beauty brands to develop exclusive customized skincare solutions for members and designing differentiated benefit systems, including pre-sale access to rare products and priority purchase rights for limited first-launches for high-tier members, effectively boosting loyalty and repeat purchase rates. In online channels, it leverages big data analytics to implement precise, tiered member operations, enhancing conversion efficiency through personalized recommendations and exclusive offers, thereby creating a closed loop between online and offline services.

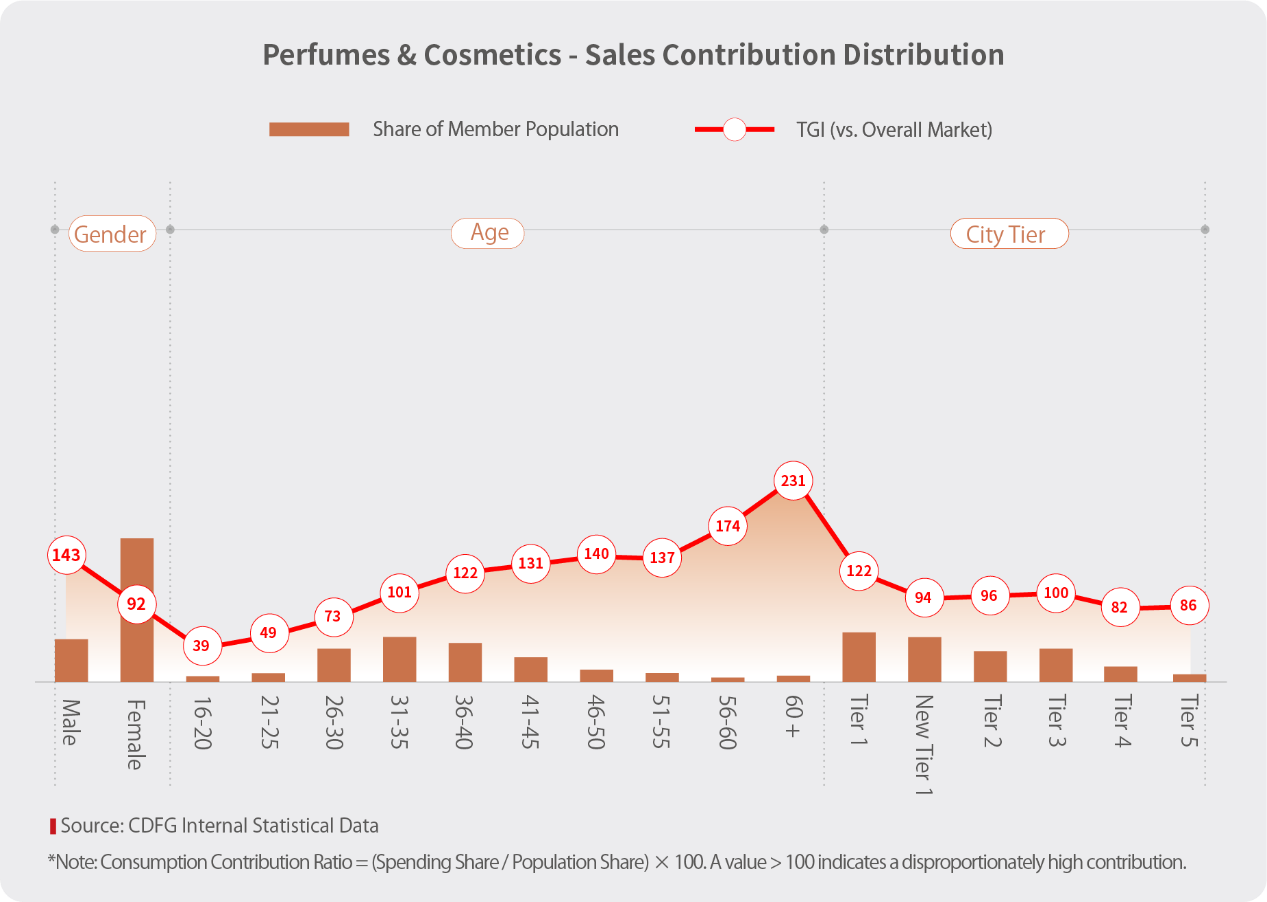

2. Luxury Goods & Accessories: Diversified Consumption Structure, Significant Growth in the Ultra-High-End Market, and Stable Demand in the Affordable Luxury Segment

The core price range of RMB 10,000-RMB 50,000 continues to contribute the main share. The sales proportion of ultra-high-end products over RMB 100,000 has doubled, demonstrating the strong spending power of HNW customers and forming a diversified consumption pattern alongside the mass market.

Source: CDFG Consumer White Paper 2024-2025

CDFG secures high-end customers with exclusive services such as “Personal Shopping Assistants + Flight Reimbursement”. It builds a full-funnel exclusive benefits system of “Shopping + Experience + Travel” for HNW customers, continuously enhancing their exclusive experiences and loyalty. This includes differentiated services like personal shopping assistance, new product showcases, and dedicated car service, as well as innovative value-added benefits like flight reimbursement and luxury goods care. For example, Very Important Customer (VIC) private events offer 1-on-1 shopping assistance from top sales associates, and in the summer of 2024, HNW members from 56 cities were offered round-trip flight reimbursements, hotel accommodations, and shopping discounts in Hainan.

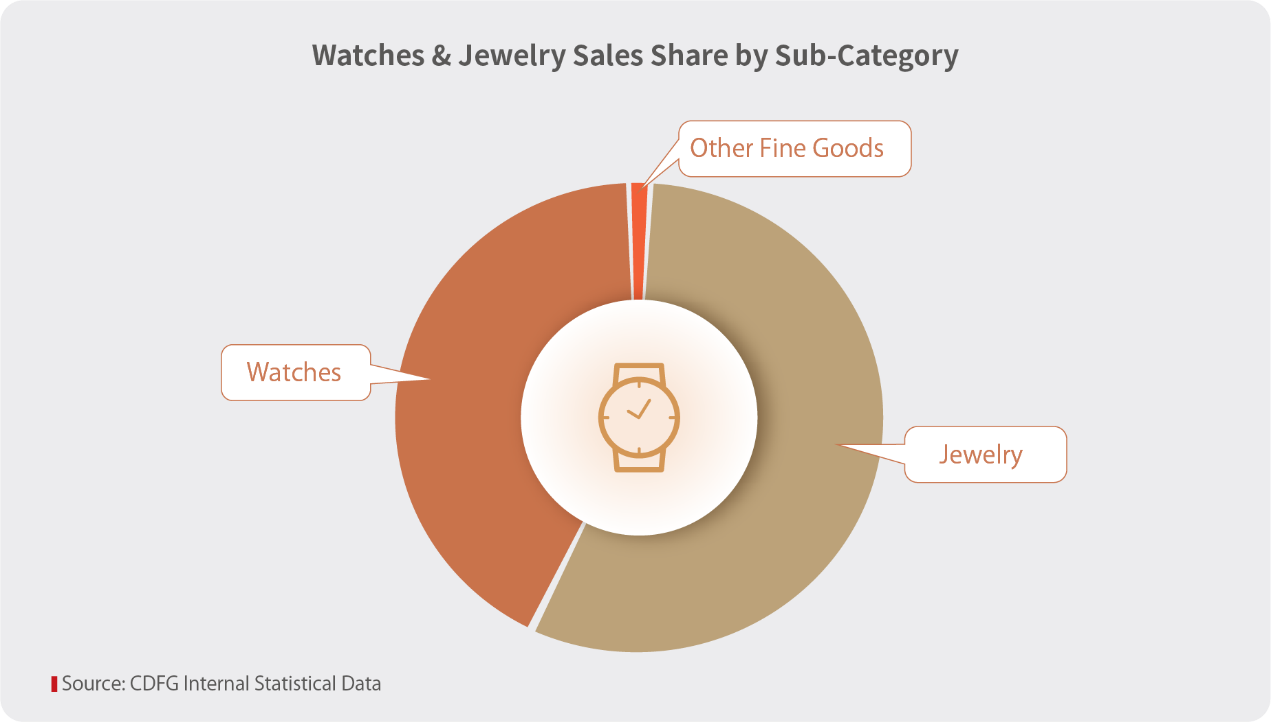

3. Watches & Jewelry: Significant Category Differentiation, Year-on-Year Growth in Jewelry, and Prominent Regional Characteristics in Watch Demand

Jewelry and watches constitute the main market share. Among these, decorative gold and jewelry products mainly attract young women aged 16-30 in Tier 1, New Tier 1, and Tier 2 cities, with consumption concentrated in the low-to-mid price range. The watch category, however, is more prominent among male customers aged 36+ in Tier 3 to Tier 5 cities. The demographic structure shows strong resilience among mature customers, consumption upgrades among younger generations, and growth in lower-tier markets.

Source: CDFG Consumer White Paper 2024-2025

For the Watches & Jewelry category, CDFG continues to strengthen the core competitiveness of leading brands, focusing on developing high-demand sub-categories such as wedding jewelry like rings and matching bands. It also actively promotes craftsmanship innovation, with products like “ancient-method gold”, which offer both aesthetic and investment value, gaining increasing favor among consumers.

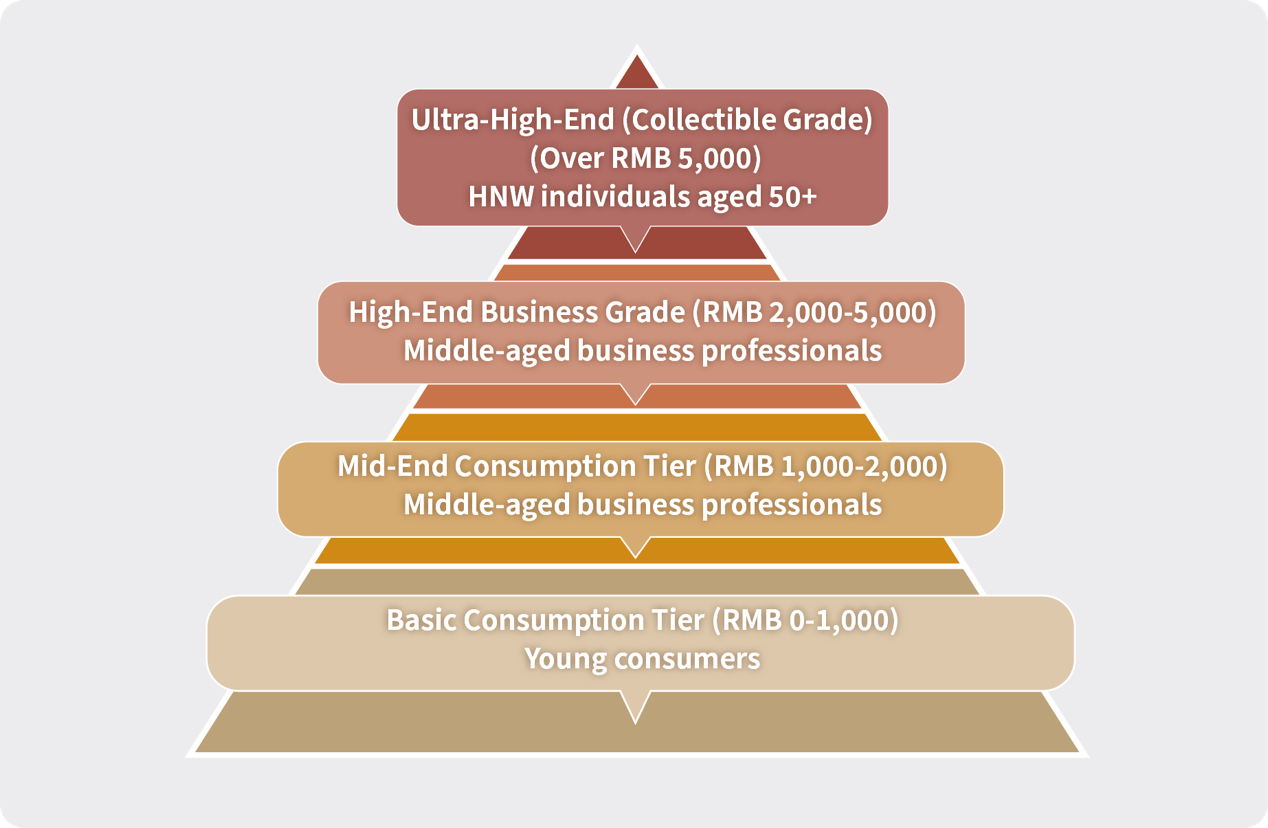

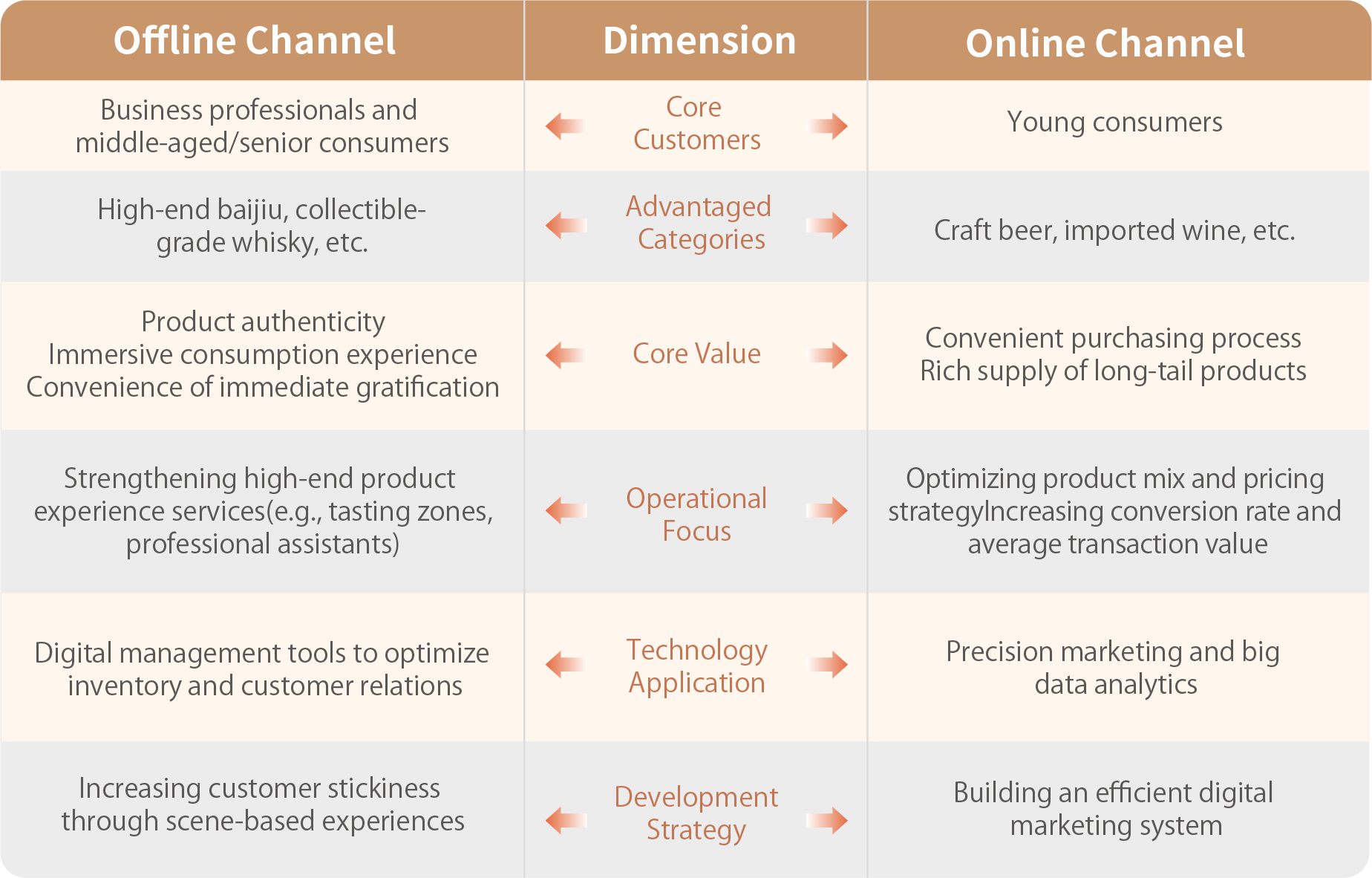

4. Wines & Spirits: Market Expansion and Upgrades, Significant Stratification in Category and Consumer Spending, and Complementary Channel Development

In 2024, the Wines & Spirits category exhibited significant characteristics of both scale expansion and structural upgrading. Market activity continued to rise, with rapid growth in total spending and the number of members. Meanwhile: category differentiation is clear, with the market showing a typical “pyramid” structure led by whisky; demand varies significantly, with men dominating spirits and the potential for low-alcohol beverages among women being unlocked; and channels are developing in a complementary way, with a strong offline rebound and stable online performance.

Source: CDFG Consumer White Paper 2024-2025

Source: CDFG Consumer White Paper 2024-2025

With its leading position in advantageous categories like whisky (winning the “2024 Travel Retailer of the Year for Whisky” award) and its forward-looking overseas layout, CDFG has seized the strategic initiative in this industry transformation. Through precise customer segmentation, differentiated merchandise strategies, and an optimized channel layout, it is poised to capture a larger share of the continuously growing market.

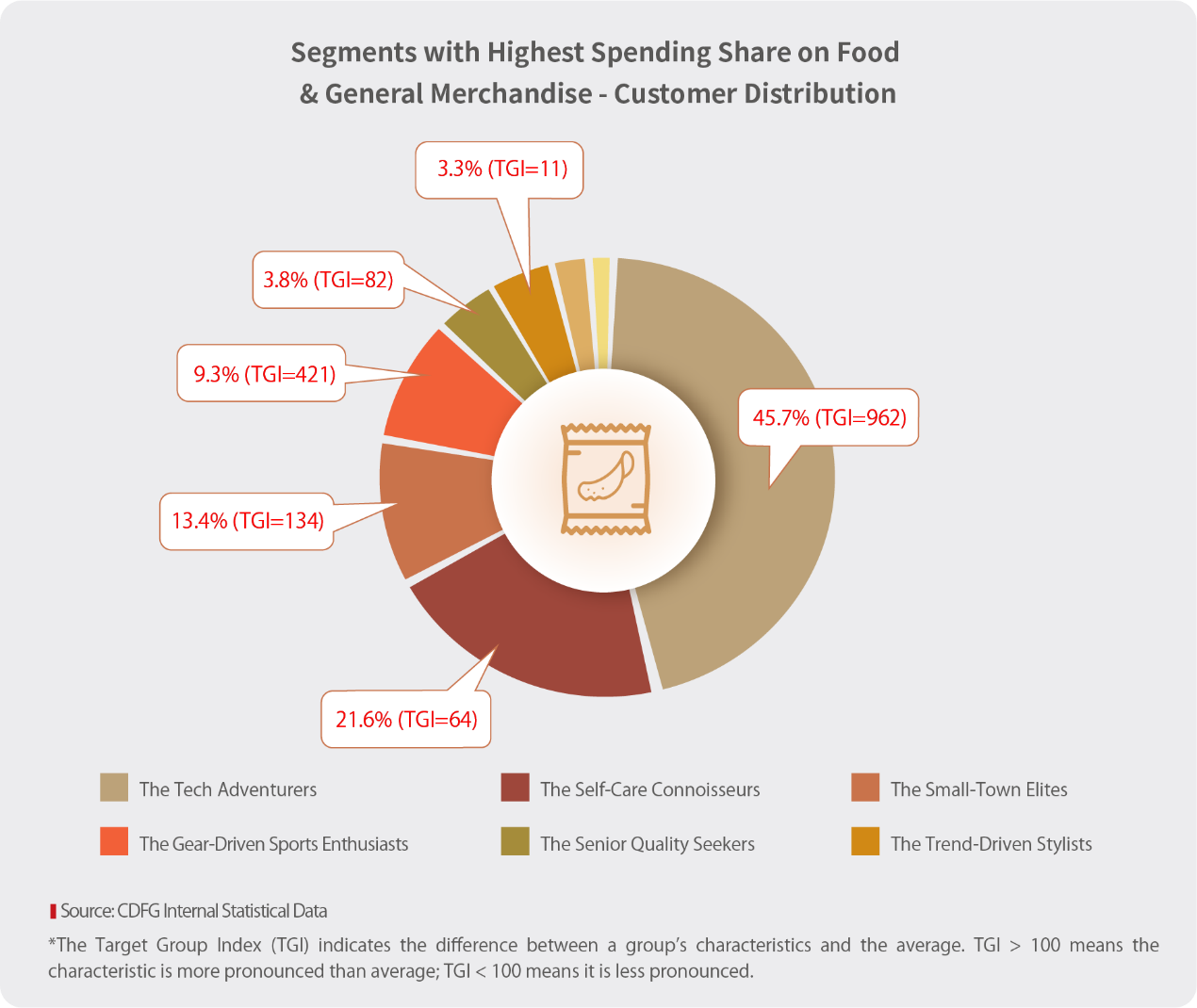

5. Food & General Merchandise: Steady Market Expansion, Distinct Segment Characteristics, with Gen Z and Seniors Driving Revolutions in Emotional and Health-focused Consumption

In 2024, the Food & General Merchandise market showed steady development, with stable overall spending and an expanding member base. At the same time, consumption across different segments revealed distinct characteristics:

The Tech Adventurers, with their core demand for digital and home electronics, form a unique “Geek Consumption Circle”;

The Tech Adventurers, with their core demand for digital and home electronics, form a unique “Geek Consumption Circle”;

The Self-Care Connoisseurs, a sizable segment, drive consumption upgrades in family scenarios, continuously releasing their purchasing power in categories like electronics, home appliances, and health supplements;

The Self-Care Connoisseurs, a sizable segment, drive consumption upgrades in family scenarios, continuously releasing their purchasing power in categories like electronics, home appliances, and health supplements;

The Aspiring Upgraders view the duty-free channels as a key gateway for quality assurance, particularly favoring authentic electronic products;

The Aspiring Upgraders view the duty-free channels as a key gateway for quality assurance, particularly favoring authentic electronic products;

The Performance Athletes focus on professional sports gear and functional products (high-protein foods, sports nutrition supplements), creating a closed-loop healthy lifestyle.

The Performance Athletes focus on professional sports gear and functional products (high-protein foods, sports nutrition supplements), creating a closed-loop healthy lifestyle.

Source: CDFG Consumer White Paper 2024-2025

Furthermore, the demands of key customer segments within the Food & General Merchandise category are undergoing profound changes. The enthusiasm of Gen Z consumers for IP merchandise and anime culture continues to grow, with the “Character Goods Economy” and emotional value becoming new growth points. The health consciousness of the senior group is increasing, with a significant rise in demand for anti-aging products and exclusive services.

CDFG is strategically positioning “Guochao Brands + Niche Scenarios” to precisely match the needs of these segments. This involves: first, deepening customer engagement, especially with precision services for Gen Z and the senior group; second, strengthening the matrix of domestic brands, helping “Guochao Going Global” through the duty-free channel; and third, optimizing the omnichannel layout to enhance the consumer experience.

Chapter 4: Trend Outlook for the Duty-Free and Travel Retail Market

1. Industry Opportunities: Structural Opportunities Emerge, Recovery Trend to Continue

In the short term, global economic fluctuations may dampen consumer confidence, but China’s projected 5% GDP growth, the recovery of outbound travel, the popularity of inbound tourism, and the policy benefits will provide a floor for the market. Short-term fluctuations cannot hide the long-term potential. China is expected to become the world’s largest duty-free market by 2025, with structural opportunities becoming prominent.

Source: CDFG Consumer White Paper 2024-2025

2. Marketing Opportunities: Targeting Nine Key Segments and Breaking Through with a “Contextual Customer Acquisition - Immersive Conversion - Emotional Retention” Model

Seizing new industry opportunities and responding to the reshaping of the customer base, a “Contextual Customer Acquisition - Immersive Conversion - Emotional Retention” marketing model can be established. Competitiveness can be enhanced by breaking through to target segments via four key measures: product innovation, scenario creation, cultural and experiential upgrades, and channel trust reinforcement.

Product Innovation: Directly Address Core Segment Needs. For example, matching The Self-Care Connoisseurs with new tech-enabled products (like smart beauty devices) and scenario-based quality solutions; introducing cutting-edge items like AI and smart home products for The Tech Adventurers, highlighting technical specs and hands-on experiences.

Product Innovation: Directly Address Core Segment Needs. For example, matching The Self-Care Connoisseurs with new tech-enabled products (like smart beauty devices) and scenario-based quality solutions; introducing cutting-edge items like AI and smart home products for The Tech Adventurers, highlighting technical specs and hands-on experiences.

Scenario Creation: Permeate Diverse Life Scenarios. For instance, creating social media buzz for The Trend-Driven Stylists by integrating “online seeding” with offline influencer experiences; recreating experiential scenes for The Spirits Aficionados at airports and the Malt & More Whisky by CDF; and operating scenario-based product portfolios for The Performance Athletes through professional sports platforms.

Scenario Creation: Permeate Diverse Life Scenarios. For instance, creating social media buzz for The Trend-Driven Stylists by integrating “online seeding” with offline influencer experiences; recreating experiential scenes for The Spirits Aficionados at airports and the Malt & More Whisky by CDF; and operating scenario-based product portfolios for The Performance Athletes through professional sports platforms.

Cultural and Experiential Upgrades: Deepen Value Alignment. For The Luxury Lifestyle Connoisseurs, focus on the cultural heritage of luxury goods, complemented by customized services and upgraded member benefits. For The Foreign Travelers, set up a “Guochao” boutique zone (integrating technology with traditional crafts) and interactive intangible cultural heritage experiences to enhance cultural perception and improve services.

Cultural and Experiential Upgrades: Deepen Value Alignment. For The Luxury Lifestyle Connoisseurs, focus on the cultural heritage of luxury goods, complemented by customized services and upgraded member benefits. For The Foreign Travelers, set up a “Guochao” boutique zone (integrating technology with traditional crafts) and interactive intangible cultural heritage experiences to enhance cultural perception and improve services.

Channel Trust Reinforcement: Solidify Customer Connections. For example, using channel trust to open up the market for The Aspiring Upgraders; upgrading services for The Spirits Aficionados to meet their business and collection needs, thereby solidifying their loyalty.

Channel Trust Reinforcement: Solidify Customer Connections. For example, using channel trust to open up the market for The Aspiring Upgraders; upgrading services for The Spirits Aficionados to meet their business and collection needs, thereby solidifying their loyalty.

3. CDFG’s Strategy: Digital-Intelligence Ecosystem Reshapes the Industry’s Value Growth Paradigm

Facing industry and marketing opportunities, CDFG will further leverage its digital-intelligence ecosystem to reshape the value growth paradigm of the duty-free and travel retail industry.

Source: CDFG Consumer White Paper 2024-2025

In the future, CDFG will use its digital-intelligence ecosystem as a core driver to deepen the “Duty-Free + Culture, Commerce, Sports, Tourism, and Health” integration. This will involve joint marketing initiatives tied to art exhibitions, sporting events, and celebrity performances to create immersive consumption experiences. At the same time, it will remain customer-centric, delivering on its brand promise of “YOUR WORLD OF DELIGHT” through stratified operations, the supply of rare goods, and omnichannel services, thereby promoting the high-quality development of the industry.

To read the full report, please click to download: CDFG Consumer White Paper 2024-2025.pdf

Disclaimer: Any third-party organization or individual intending to reproduce this report must do so in its original, unmodified form. Any alterations to the content must be reviewed and approved by China Duty Free Group prior to publication. Furthermore, any reproduction must include the following information and disclaimer: The intellectual property rights of this report belong to China Duty Free Group (hereinafter referred to as “the Company”). The content herein is for general informational purposes only, and neither the Company nor its subsidiaries shall be construed as providing any professional advice or services hereby. The Company shall not be liable for any loss incurred by any party as a result of using the content of this report. This report is compiled and analyzed based on extensive literature research, data from authoritative international organizations, internal company statistics, and survey questionnaires. The information is current as of the date of publication, and the conclusions are for research reference only.